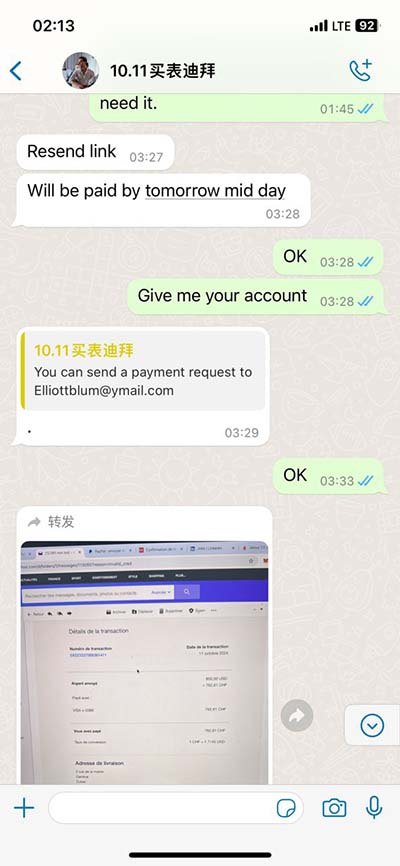

fake credit card dispute clothing purchased Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute . Buy Now. Amahagan World Malt Edition No.3 is a Japanese malt whisky from Nagahama distillery, that has been finished in Mizunara wood. Aromas of orchard fruits, juicy oranges, sweet caramel and fragrant oak fill the .

0 · legitimate credit card disputes

1 · how to dispute credit card charges

2 · fraudulent credit card dispute

3 · false credit card claim

4 · credit card disputes

5 · credit card dispute settlement

6 · credit card dispute investigation

7 · credit card dispute cases examples

Amazon.com ships worldwide. AMAZON DELIVERS TO YOU. Worldwide shipping We ship to over 100 countries and regions, right to your doorstep. Check your location. SHOP WITH CONFIDENCE. Safe and secure payments We protect your personal payment information. Learn more about payments. EXPERIENCE THE AMAZON ADVANTAGE. .

legitimate credit card disputes

You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. . Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute .

cartier houston photos

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this . If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can .

What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either .If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect .

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent . According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a.

But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders. Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always . The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims.

If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or .

According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.

Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always . The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims. If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372).

What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or .

how to dispute credit card charges

fraudulent credit card dispute

chanel coco mademoiselle eau de parfum 3 x 20 ml

false credit card claim

Can You Transfer an Amazon Gift Card to Another Country Directly? Alternative Ways to Use Your Amazon Gift Card Abroad. Digital Products and Global Shipping; Gifting to .

fake credit card dispute clothing purchased|credit card dispute investigation